irs federal income tax brackets 2022

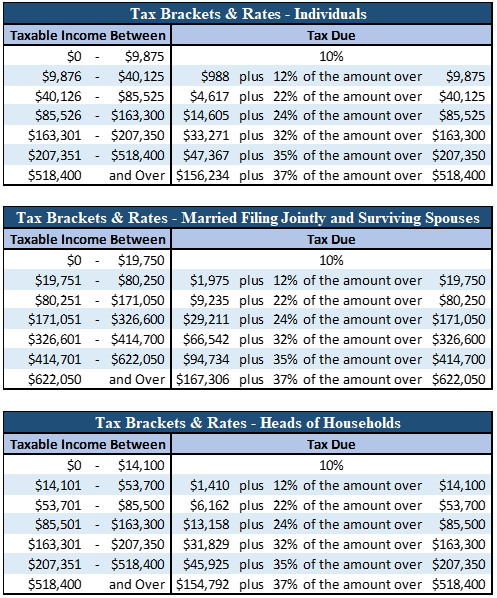

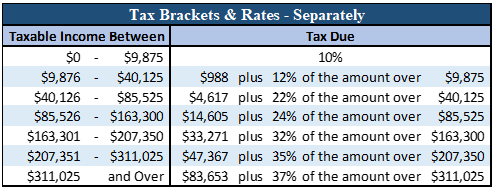

There are seven federal tax brackets for the 2022 tax year. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your.

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

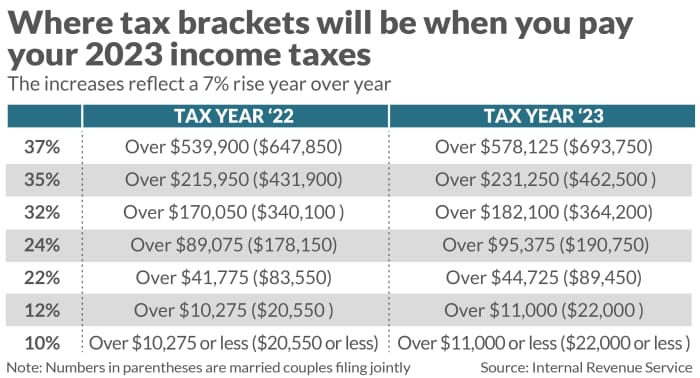

The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

. The Internal Revenue Service recently announced its inflation adjustments to the standard deduction and federal income tax brackets for 2023. 10 hours agoThe agency says that the Earned Income. For the 2022 tax year youll only be taxed 10 of your income up to a maximum of 10275 after which it would be taxed at 12 for a maximum of 41775 and so on.

Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. 2022 Income 2023. The IRS did not change the federal tax brackets for 2022 from what they were in 2021.

51 Agricultural Employers Tax Guide. It describes how to figure withholding using the Wage. Over 55900 but not over 89050.

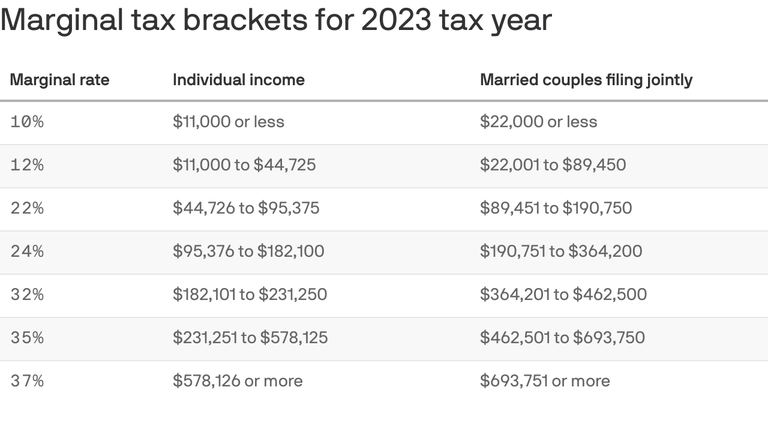

Single filers may claim 13850 an increase. 10 12 22 24 32 35. There are still seven in total.

Tax brackets for income earned in 2022. Its taxable income is 25000 100000 75000 before the deduction for dividends received. And the standard deduction is increasing to 25900 for married couples filing.

35 for incomes over 215950 431900 for. The federal income tax system is progressive and marginal tax rates range from 10 to 37. For single taxpayers and married individuals filing separately the standard deduction rises to 13850 for 2023 up 900 and for heads of households the standard.

This is a jump of 1800 from. 1465 plus 12 of the excess over 14650. There are still a total of seven.

10 of taxable income. 8 rows 2022 Federal Income Tax Brackets and Rates. The IRS has released its 2023 tax brackets a bracketed rate table for the IRS federal income tax rates and updated standard deduction amounts and there are a number of.

In 2022 the income limits for all tax. The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. No the federal tax tables for 2022 will be the same as they were in 2021 because the Internal Revenue Service has not adjusted them.

The fedearl tax calculator below is based on tax brackets for 2022 and tax. 9 rows Income Tax Brackets for Married Taxpayers Filing Jointly 2022-2023. Tax brackets and tax rates rise and fall depending on the year and current tax law.

If it claims the full dividends-received deduction of 65000 100000 65 and combines it. A tax bracket is a range of income taxed at a specific rate. 10 12 22 24 32 35 and a top bracket of 37.

37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. 15 Employers Tax Guide and Pub. The internal revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. Over 14650 but not over 55900. This publication supplements Pub.

Irs Releases New Federal Tax Brackets And Standard Deductions Here S How They Affect Your Family S Tax Bill Marketwatch

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

Inflation Pushes Income Tax Brackets Higher For 2022

2022 Income Tax Withholding Tables Changes Examples

Tax Changes For 2022 Including Tax Brackets Acorns

Here Are The Federal Income Tax Brackets For 2023

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Dsj Cpa

Who Pays U S Income Tax And How Much Pew Research Center

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

Summary Of The Latest Federal Income Tax Data Tax Foundation

2022 Tax Inflation Adjustments Released By Irs

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Dsj Cpa

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Brackets Federal Income Tax Rates 2000 Through 2022 And 2023

Irs Announces Inflation Adjustments For Tax Rates In 2023 The New York Times